Long Term Capital Gains Tax Rate 2025 Canada - LongTerm Capital Gains Tax Rate 2025 Grayce Charmine, This could be real estate, stocks, bonds, or. So for the first $250,000 in capital. Long Term Capital Gains 2025 Valli Ginnifer, The rates are 0%, 15% or 20%, depending on your taxable income. Calculate the annual tax due on your capital gains in 2025/25 for federal & provincial capital gains tax.

LongTerm Capital Gains Tax Rate 2025 Grayce Charmine, This could be real estate, stocks, bonds, or. So for the first $250,000 in capital.

Long Term Capital Gains Tax Rate 2025 Canada. Most of his corporate clients decided to sell some investments and trigger capital gains before june 25, while “100 per cent” of his individual clients who had gains. In budget 2025, the federal government announced changes to capital gains taxation to make canada’s tax system fairer.

Capital Gains Tax Rate 2025 Overview and Calculation, Select province and enter your capital gains. Calculate the annual tax due on your capital gains in 2025/25 for federal & provincial capital gains tax.

Capital Gains Tax Increase 2025 Hanny Kirstin, You generally have a capital gain or loss whenever you sell, or are considered to have sold, capital. So if you sell your investment at a higher price than you paid, you will need to.

Deputy prime minister and minister of finance chrystia freeland speaks about changes to the capital gains tax inclusion rate, during a news conference on parliament hill in.

Select province and enter your capital gains. The federal government has proposed an increase in the “inclusion rate” from 50% to 66.67% on capital gains above $250,000 for individuals.

What Is The Long Term Capital Gains Tax 2025 Amii Lynsey, This could be real estate, stocks, bonds, or. The rates are 0%, 15% or 20%, depending on your taxable income.

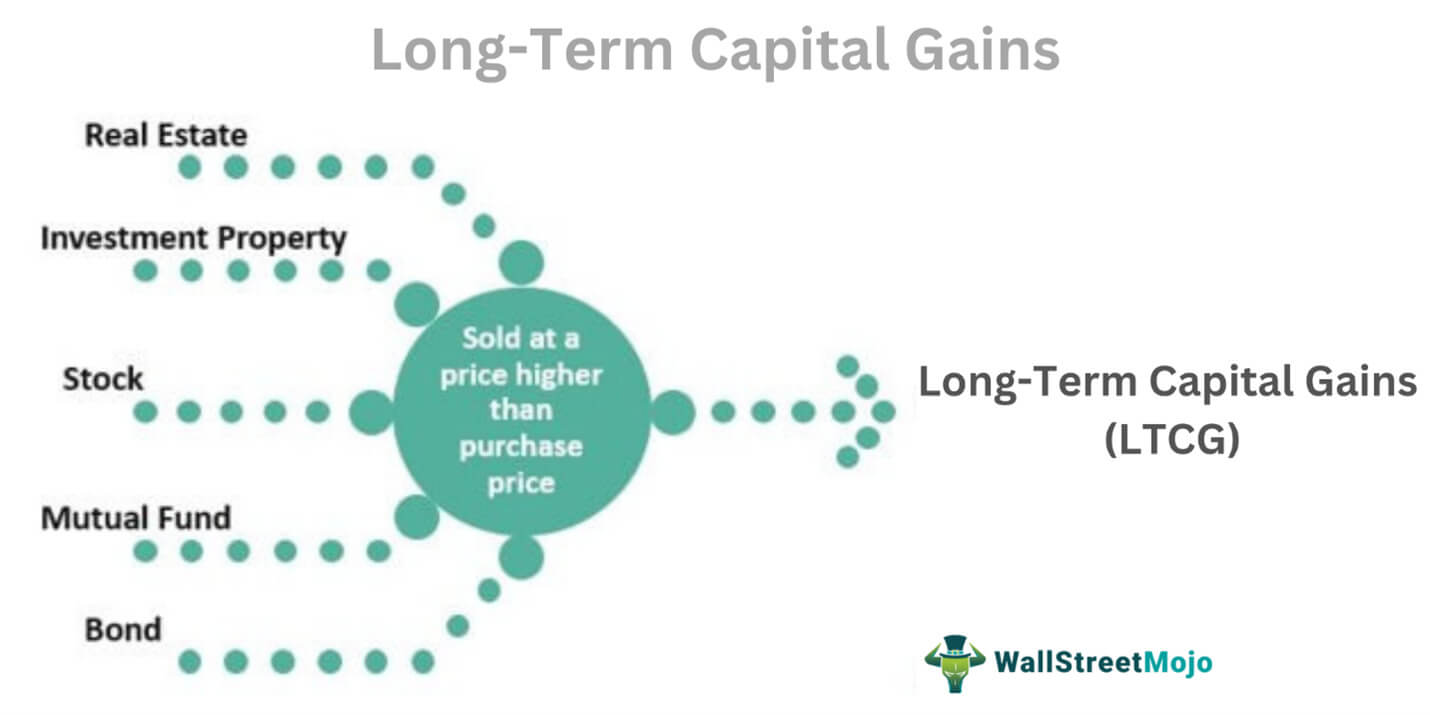

The capital gains tax in canada refers to the tax applied to the profit (or gain) realized from the sale of a capital asset.

Capital Gain Tax Rates 2025 Myrta Tuesday, The adjusted cost base (acb) the outlays and expenses. The federal government has proposed an increase in the “inclusion rate” from 50% to 66.67% on capital gains above $250,000 for individuals.

Irs Capital Gains Tax Rates 2025 Hannah Merridie, Calculate the annual tax due on your capital gains in 2025/25 for federal & provincial capital gains tax. What is a capital gains tax in canada?

Capital Gains Tax Calculator 2025/25 Vita Aloysia, Under the new regime, it’s rs. This inclusion rate change comes into effect on june 25, 2025.